Which country is the most attractive market for investors?

Perhaps Brazil? Russia? India? China? Collectively, those four are known as the "BRIC" countries and for a number of years, many investors have pointed to them as economic stars. However, in a global quarterly poll of investors and analysts who are Bloomberg subscribers released on June 8, "Almost four of 10 respondents picked the U.S. as the market presenting the best opportunities in the year ahead." That placed the U.S. #1 on the list followed by Brazil, China, and India.

Of course, this is simply the opinion of a group of investors and analysts and it does not mean that the U.S. will turn out to be the best market. But, it does raise an interesting observation, which is… there are countries with good economics and countries with good investment opportunities--and they are not always the same.

Here's what I mean. In the first quarter of 2010, Brazil, India, and China's economies expanded at an annual rate of 9.0%, 8.6%, and 11.9%, respectively, as measured by gross domestic product, according to Bloomberg. That's huge. By contrast, the U.S. economy expanded at a relatively modest 3.0% in the first quarter, according to the Bureau of Economic Analysis. On the surface, you might think that the three countries with the highest economic growth rates would also present the most attractive investment opportunities. Possibly yes, but the latest survey from Bloomberg put the good ol' USA in the #1 spot.

Why would these investors and analysts put a slower-growing U.S. ahead of fast-growing Brazil, India, and China? There could be numerous reasons, but a simple takeaway is this--in the short-term, good economics does not always translate into good investment opportunities. For example, if the fast economic growth in Brazil, India, and China was already "priced into" their financial markets, then the near-term outlook for stock prices might be muted. Conversely, if the modest growth in the U.S. helped drive our stock prices down to a relatively low level, then we might be in the best position to experience a bounce from this "oversold" condition.

This is a long-winded way of saying short-term market movements might not reflect current economic realities.

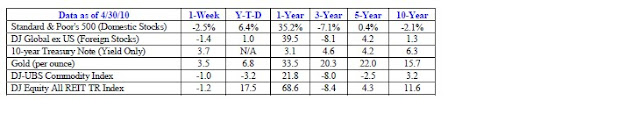

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable or not available.

DID YOU FEEL WEALTHIER in the first 3 months of this year? Well, believe it or not, the net worth of U.S. households rose by $1.1 trillion in the first quarter, according to the Federal Reserve. Most of this increase came from rising stock prices. And, if you believe economists, each extra dollar of wealth should generate about 5 cents of spending over time, according to MarketWatch. Dubbed "The Wealth Effect," it suggests that rising stock prices could lead to a virtuous cycle of higher spending, higher corporate earnings, and higher stock prices. That's the good news.

Here's the bad news. The theory also works in reverse.

Yes, household net worth was up in the first quarter, but it is still down about $11.4 trillion from its early 2007 peak, according to MarketWatch. And, with the roughly 7% slide we've seen in S&P 500 so far in the second quarter, we may see the net worth number drop when the second quarter data is released in a few months.

This net worth data and the stretched balance sheets of many Americans leaves us with a conundrum. On one hand, consumer spending accounts for about 70% of U.S. economic activity, according to Associated Press. So, if we want robust economic growth, we need consumers to open their wallets and start buying stuff. On the other hand, the pragmatic observer says consumers are already too much in debt and need to curb their spending and build up their savings. This could lead to slower growth.

Essentially, we can keep spending by going deeper in debt and hope we can "leverage" our way to prosperity. Or, we can cut our spending, increase our savings, and gradually build our way back to a sustainable growth rate. Both scenarios would likely cause some pain. The former scenario would likely delay the pain. The latter scenario would likely speed it up.

Sooner or later, don't be surprised if we enter an "Age of Austerity" that enables (forces?) consumers to reduce their debts, and, after a painful adjustment, puts our country back on a path to prosperity.

Weekly Focus – Think About It

"I have learned, as a rule of thumb, never to ask whether you can do something. Say, instead, that you are doing it. Then fasten your seat belt. The most remarkable things follow." --Julia Cameron

Best regards,

Kevin Kroskey

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

* The DJ Global ex US is an unmanaged group of non-U.S. securities designed to reflect the performance of the global equity securities that have readily available prices.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the London afternoon gold price fix as reported by the London Bullion Market Association.

* The DJ Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT TR Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* This newsletter was prepared by PEAK.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results.

* You cannot invest directly in an index.