Looking back on 2014, people are going to say it was a great year to be an investor. They won’t remember how uncertain the journey felt right up to the last day of a year that saw the S&P 500 close at a record level on 53 different days. Think back over a good year in the market. Was there ever a time when you felt confidently bullish that the markets were taking off and delivering double-digit returns?

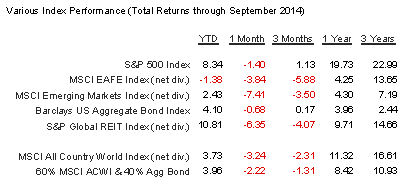

Key index performance is shown in the table below.

Key index performance is shown in the table below.

Part of the reason that U.S. stocks performed so well when investors seemed to be constantly looking over their shoulders is interest rates—specifically, the fact that interest rates remained stubbornly low, aided, in no small part, by a Federal Reserve that seems determined not to let the markets dictate bond yields until the economy is firmly and definitively on its feet. The Bloomberg U.S. Corporate Bond Index now has an effective yield of 3.13%, giving its investors a windfall return of 7.27% for the year due to falling bond rates. 30-year Treasuries are yielding 2.75%, and 10-year Treasuries currently yield 2.17%. At the low end, 3-month T-bills are still yielding a miniscule 0.04%; 6-month bills are only slightly more generous, at 0.12%.

Normally when the U.S. investment markets have posted six consecutive years of gains, five of them in double-digit territory, you would expect to see a kind of euphoria sweep through the ranks of investors. But for most of 2014, investors in aggregate seemed to vacillate between caution and fear, hanging on every economic and jobs report, paying close attention to the Federal Reserve Board’s pronouncements, seemingly trying to find the bad news in the long, steady economic recovery.

One of the most interesting aspects of 2014—and, indeed, the entire U.S. bull market period since 2009—is that so many people think portfolio diversification was a bad thing for their wealth. When global stocks are down compared with the U.S. markets, U.S. investors tend to look at their statements and wonder why they’re lagging the S&P index that they see on the nightly news. This year, commodity-related investments were also down significantly, producing even more drag during what was otherwise a good investment year.

But that’s the point of diversification: when the year began, none of us knew whether the U.S., Europe, both or neither would finish the year in positive territory. Holding some of each is a prudent strategy, yet the eye inevitably turns to the declining investment which, in hindsight, pulled the overall returns down a bit. At the end of next year, we may be looking at U.S. stocks with the same gimlet eye and feeling grateful that we were invested in global stocks as a way to contain the damage; there’s no way to know in advance.

Is a decline in U.S. stocks likely? One can never predict these things in advance, but the usual recipe for a terrible market year is a period right beforehand when investors finally throw caution to the winds, and those who never joined the bull market run decide it’s time to crash the party. The markets have a habit of punishing overconfidence, but we don’t seem to be seeing that quite yet. However, been many valuation metrics, US stocks seem expensive.

What we ARE seeing is kind of boring: a long, slow economic recovery in the U.S., a slow housing recovery, healthy but not spectacular job creation in the U.S., stagnation and fears of another Greek default in Europe, stocks trading at values slightly higher than historical norms and a Fed policy that seems to be waiting for certainty or a Sign from Above that the recovery will survive a return to normal interest rates.

On the plus side for consumers, we also saw a 46% decline in crude oil prices, saving U.S. drivers approximately $14 billion this year.

The Fed has signaled that it plans to take its foot off of interest rates sometime in the middle of next year. The questions that nobody can answer are important ones: Will the recovery gain steam and perhaps help companies increase earnings growth to help justify lofty valuations in the year ahead? Will Europe stabilize and ultimately recover, raising the value of European stocks? Will oil prices remain low, giving a continuing boost to portions the economy? Or will, contrary to long history, the markets flop without any kind of a euphoric top?

We can’t answer any of these questions, of course. What we do know is that since 1958, the U.S. markets, as measured by the S&P 500 index, have been up 53% of all trading days, 58% of all months, 63% of all quarters and 72% of the years. Over 10-year rolling time periods, the markets have been up 88% of the time. These figures do not include the value of the dividends that investors were paid for hanging onto their stock investments during each of the time periods.

Yet since 1875, the S&P 500 has never risen for seven calendar years in a row. Could 2015 break that streak? Stay tuned.

To Your Prosperity,

Kevin Kroskey, CFP®, MBA

This article adapted with permission from Bob Veres.

Sources:

S&P index data: http://www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa-500-usduf--p-us-http://money.cnn.com/2014/09/30/investing/stocks-market-september-slump/index.html

International indices: http://www.mscibarra.com/products/indices/international_equity_indices/performance.html

Treasury market rates: http://www.bloomberg.com/markets/rates-bonds/government

Aggregate corporate bond rates: https://indices.barcap.com/show?url=Benchmark_Indices/Aggregate/Bond_Indices