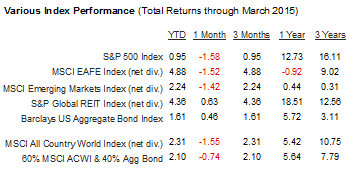

The first quarter of the new year has

brought us small positive returns in many of the U.S. and global indices and

more than the usual amount of anxiety along with them. See below for common

market benchmark performance.

If you were watching the markets day to

day, you experienced a mild roller coaster, what trading professionals refer to

as a sideways market. One day it was up,

the next down, each day (or week) seeming to erase the gains or losses of the previous

ones. The best explanation for this

phenomenon is that investors are still looking over their shoulders at interest

rates, waiting for bond yields to jump higher, making bonds more competitive

with stocks and triggering an outflow from the stock market that could (so the

reasoning goes) cause a bear market in U.S. equities.

However, investors have been waiting

for this shoe to drop for the better part of three years, and meanwhile,

interest rates have drifted decidedly lower in the first quarter. The Bloomberg U.S. Corporate Bond Index now

has an effective yield of 2.93%. 30-year

Treasuries are yielding 2.48%, roughly 0.3% lower than in December, and 10-year

Treasuries currently yield 1.87%, down from 2.17% at the beginning of the

year.

This interest rate watch has created a

peculiar dynamic where up is down and down is up in terms of how traders and

stock market gamblers look at the future.

The generally positive economic news is greeted with dismay (The Fed

will notice and start raising rates sooner rather than later! Boo!) and any bad news sends the stock

market back up again into mild euphoria (The Fed might hold off another

quarter! Yay!).

The Fed’s future actions are

inscrutable. You will hear knowledgeable

Fed-watchers say that the Fed will take action as early as June or as late as

next year, and none of them really know.

We should all welcome the Fed pullback,

not fear it. A lot of the uncertainty

among traders and even long-term investors is coming from anxiety over how this

experiment is going to end. The U.S.

Central bank has directly intervened in the markets and in the economy, and is

still doing so. When that ends, normal

market forces will take over, and we’ll all have a better handle on what

“normal” means in this economic era. Is

there great demand for credit to fuel growth?

What would rational investors pay for Treasury and corporate bonds if

they weren’t bidding against an 800-pound gorilla? Would retirees prefer an absolutely certain

4.5% return on 30-year Treasury bonds or the less certain (but historically

higher) returns they can get from the stock market? These are questions that all of us would like

to know the answer to, and we won’t until all the QE interventions have ended.

What DO we know? Data shows that the U.S. economy is less

dependent on foreign oil than at any time since 1987, and the trend is moving

toward complete independence. Oil—and

energy generally—is cheaper now than it has been in several decades, which

makes our lives, and the production of goods and services, less expensive.

Meanwhile, more Americans are

working. Figure 3 shows that the U.S.

unemployment rate—at 5.5%—is trending dramatically lower and is now reaching

levels that are actually below the long-term norms. Unemployment today is lower than the rate for

much of the booming ‘90s, and is approaching the lows of the early 1970s.

And real GDP—the broadest measure of

economic activity in the United States—increased 2.4% last year, after rising

2.2% the previous year. America is

growing. Not rapidly, but slow growth

might not be so terrible. Rapid economic

growth has, in the past, often preceded economic recessions, where excesses had

to be corrected. Slow, steady growth may

be boring, but it’s certainly not bad news for the economy or the

markets.

It has been said that

people lose far more money in opportunity costs by trying to avoid future

market downturns while the markets are still going up than by holding their

ground during actual downturns. And, in

fact, in every case so far, the U.S. market has eventually made up the ground

it lost in every bear market we’ve experienced.

The last trading day of the quarter looked bearish, as have many other

gloomy trading days during this seven year bull market. It seems like every week, somebody else has

predicted an imminent decline that has not happened. People who listened to the alarmists lost out

on solid returns. You filter out the

good news at your peril.

To Your Prosperity,

Kevin Kroskey, CFP®, MBA

This article adapted with permission from Bob Veres.

Sources:Wilshire index data: http://www.wilshire.com/Indexes/calculator/

Russell index data: http://www.russell.com/indexes/data/daily_total_returns_us.asp

S&P index data: http://www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa-500-usduf--p-us-l--

http://www.tradingeconomics.com/united-states/unemployment-rate

Nasdaq index data: http://quicktake.morningstar.com/Index/IndexCharts.aspx?Symbol=COMP

International indices: http://www.mscibarra.com/products/indices/international_equity_indices/performance.html

Commodities index data: http://us.spindices.com/index-family/commodities/sp-gsci

Treasury market rates: http://www.bloomberg.com/markets/rates-bonds/government-bonds/us/

http://www.bloomberg.com/news/articles/2015-04-01/u-s-oil-imports-from-opec-have-plunged-to-a-28-year-low

Aggregate corporate bond rates: https://indices.barcap.com/show?url=Benchmark_Indices/Aggregate/Bond_Indices

Aggregate corporate bond rates: http://www.bloomberg.com/markets/rates-bonds/corporate-bonds/

http://bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm