The U.S. stock market just entered its first correction of 10% since the March 2009 bear market low, according to Barron's magazine. In the paraphrased words of economist Michael Darda as reported by Barron's, are we experiencing an aftershock of the 2008 market crisis or are we having a relapse?

Catalysts for this recent correction are varied. China is clamping down on its easy money policy. Several European countries are in the midst of a liquidity/solvency problem. In the U.S., jobless claims unexpectedly rose last week and the Conference Board reported a surprising drop in its index of leading economic indicators. Both reports raised concerns that the economic rebound in the U.S. may be losing some strength, according to Bloomberg.

The case for optimism is also in plain sight. U.S. News and World Report says two new surveys out last week suggest, "We might be on the verge of experiencing the Great Shopping Comeback of 2010." Higher consumer spending could propel the economy and create jobs. In corporate America, first quarter earnings for the S&P 500 companies grew 55% from a year earlier and 77% of them beat their Wall Street estimate, according to Bloomberg. And, according to Federal Reserve Bank of New York President William Dudley as reported by Bloomberg, "The U.S. economy is recovering and we are now seeing the first signs of significant employment growth."

Economist Darda answered his own question and said we're simply having an aftershock, not a relapse. Even if he turns out to be correct, aftershocks could still generate some "scary headlines" in the near future. As always, we do our best to stay on top of these types of evolving situations.

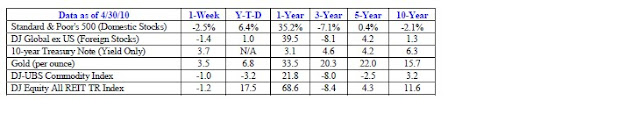

Notes: S&;P 500, DJ Global ex US, Gold, DJ-UBS Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT TR Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable or not available.

"History provides a crucial insight regarding market crises: They are inevitable, painful, and ultimately surmountable." --Shelby M.C. Davis, legendary investor

It's been said that we can count on death and taxes. We should also add "market crises" to the list. It seems like the market is always either in a crisis, recovering from a crisis, or anticipating the next crisis. According to a January 2010 Morningstar article, we've experienced numerous "crises" over the past four decades including the following:

- In the 1970s, we had stagflation, oil shocks, high inflation, and a stock market that dropped 44% in 2 years.

- In the 1980s, we had the collapse of Drexel Burnham Lambert and the stock market crash of October 1987, which sent the Dow Jones Industrial Average down more than 20% in one day.

- In the 1990s, we had the savings and loan crisis, the bailout of hedge fund Long Term Capital Management, and the Asian financial crisis.

- In the 2000s, we had two bear markets, the subprime mortgage meltdown, and the financial crisis of 2008-2009.

It's easy for investors to let the events of the day or the "crisis du jour" cloud their thinking. However, successful investors take a wider view and realize that crises happen, crises get resolved, and while they can sometime be scary, they should not lead you to panic mode.

Weekly Focus – Think About It

"Close scrutiny will show that most 'crisis situations' are opportunities to either advance or stay where you are." --Maxwell Maltz

Best regards,

Kevin Kroskey

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

* The DJ Global ex US is an unmanaged group of non-U.S. securities designed to reflect the performance of the global equity securities that have readily available prices.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the London afternoon gold price fix as reported by the London Bullion Market Association.

* The DJ Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT TR Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* This newsletter was prepared by PEAK.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.