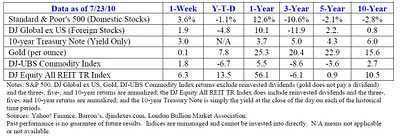

Despite a disappointing jobs report, stocks still managed to post a solid gain last week. In fact, all three major U.S. indexes --the Dow Jones Industrial Average, the S&P 500, and the NASDAQ Composite --ended last week in positive territory for the year, according to CNBC.

Strong corporate earnings are helping to keep a floor under the market. Roughly 75% of the companies that have reported second quarter earnings beat Wall Street estimates, according to CNBC. Of course, one factor that helped corporate America post strong earnings was keeping a tight rein on employment costs. Unfortunately, what’s good for corporate America may not always be good for “employment” America.

Bond yields continued to decline last week as the 2-year Treasury hit a record low of 0.50%. The 10-year Treasury yielded 2.82%, which is a 15-month low. Foreign country bonds are sporting low yields, too. The 10-year German Bund hit a record low yield of 2.51% last week, while the benchmark Japanese 10-year government bond yielded just 1.05% last week, according to Barron’s.

Low yields suggest either slower economic growth ahead or little to no inflation, or both, according to Barron’s. Low rates are generally good for businesses because it makes their cost of capital lower and makes it easier for them to reinvest for future growth. So far, the low rates appear to have helped stabilize the economy, but robust growth and reinvestment has yet to materialize, according to The New York Times.

Overall, the mixed economic data is helping keep the market stuck in a broad range.

“WE ARE IN A NEW NORMAL WORLD in which the distribution of outcomes is flatter and the tails are fatter,” according to a July 2010 Global Perspective report from Richard Clarida of PIMCO. What in the world does that mean?

Clarida’s words might sound like mumbo jumbo, but he actually makes a solid case that planning for “extreme” outcomes rather than “average” outcomes might be the appropriate investment strategy in the current climate.

History tells us that the average annualized total return on the S&P 500 between 1926 and 2009 was 9.9% and the standard deviation was 19.2, according to TD Ameritrade. Standard deviation is a measure of volatility and at 19.2 (one standard deviation), it means that about 68% of the time, we would expect the S&P 500 annual return to be somewhere between a loss of 9.3% and a gain of 29.1%. At two standard deviations, it means that about 95% of the time, we would expect the S&P 500 to return somewhere between a loss of 28.5% and a gain of 48.3%. At three standard deviations, it means that about 99.7% of the time, we would expect the S&P 500 to return somewhere between a loss of 47.7% and gain of 67.5%.

Clarida is suggesting that, in the future, more of the returns in the financial markets will fall in the 2nd or 3rd standard deviation range (the “fat tail”) instead of the 1 standard deviation range (the “hump”). If true, this means we could expect more volatility -- both positive and negative -- in the future.

The future could be more volatile due to such things as the unpredictable nature of government regulation and bailouts, sovereign debt levels, high-frequency trading, geopolitical flare-ups, social unrest, high unemployment, and medical or scientific breakthroughs.

Recent events such as the May 6 “Flash Crash,” the 2008 financial crisis, the 2007-2009 bear market, and the 2008 spike and then collapse in oil prices, support Clarida’s idea that we live in volatile times.

So, if we are temporarily living in a “fat tail” world, then it makes sense to plan accordingly. And, that’s what we’re trying to do on your behalf.

Weekly Focus – Think About It

“Take calculated risks. That is quite different from being rash.”

-- General George S. Patton

Best regards,

Kevin Kroskey

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

* The DJ Global ex US is an unmanaged group of non-U.S. securities designed to reflect the performance of the global equity securities that have readily available prices.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the London afternoon gold price fix as reported by the London Bullion Market Association.

* This newsletter was prepared by PEAK.

* The DJ Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT TR Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.