Last month, the Consumer Price Index rose 0.2% with core CPI flat for the third month in a row. Core CPI has advanced at a crawl in the past 12 months: just 0.6% compared to a Federal Reserve annualized target of 2.0%. Producer prices rose 0.4% last month, duplicating their August and September increase. Yet core producer prices fell 0.6%.1,2

HOUSING STARTS SLIP, MORTGAGE RATES JUMP

The Commerce Department announced an 11.7% slump in new residential construction starts for the month of October, and a 1.9% slip from year-ago levels. A drop in apartment and condo construction accounted for most of the October decline. Last week, Freddie Mac said that the average rate on a 30-year conventional home loan had jumped to 4.39% from 4.17% a week prior. The average rate for a 15-year FRM had increased to 3.76%, up from 3.57% in Freddie’s previous survey.3,4

RETAIL SALES 7.3% BETTER THAN A YEAR AGO

Car buying drove a 1.2% gain in U.S. retail sales in October. In fact, the Census Bureau reported a 14.7% year-over-year increase in sales volume at car dealerships. The year-over-year gain in overall retail sales was 7.3%, and 13.5% for non-store retailers.5

CONFERENCE BOARD INDEX UP 0.5%

The Conference Board’s index of leading economic indicators notched its second straight half-percent increase in October. This was also its fourth straight advance.6

GM IPO TURNS THE WEEK AROUND

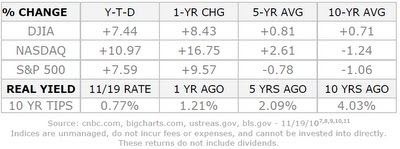

Thursday’s eagerly awaited initial public offering from General Motors sent the Dow on a triple-digit rally and turned a down week into a flat one. Here is how the three marquee indices performed last week: DJIA, +0.10% to 11,203.55; S&P 500, +0.04% to 1,199.73; NASDAQ, 0.00% to 2,518.12 (it actually fell .09 on the week).7,8

COMING NEXT WEEK: No economic releases are scheduled for Monday. Tuesday, we have October existing home sales and the release of the minutes from the Fed’s November 3 policy meeting, plus the second estimate of 3Q GDP. Wednesday, we have even more data: the October consumer spending report, October new home sales, October durable goods orders and the final November consumer sentiment survey from the University of Michigan.

WEEKLY QUOTE

“You are the only real obstacle in your path to a fulfilling life.”

– Les Brown

WEEKLY TIP

Ramp up your college savings with rewards programs. There are credit cards and online shopping programs that can allow you to direct a steady stream of rebates toward your education fund.

Best Regards,

Kevin Kroskey

Citations.

1 - marketwatch.com/story/us-consumer-prices-up-02-in-october-2010-11-17 [11/17/10]

2 - blogs.barrons.com/stockstowatchtoday/2010/11/16/producer-prices-lower-than-expected-but-crude-prices-jump/ [11/16/10]

3 - articles.latimes.com/print/2010/nov/18/business/la-fi-housing-mortgage-20101118 [11/18/10]

4 - freddiemac.com/pmms/release.html [11/18/10]

5 - census.gov/retail/marts/www/marts_current.pdf [11/15/10]

6 -boston.com/news/nation/washington/articles/2010/11/19/new_figures_indicate_economy_is _picking_up [11/19/10]

7 - cnbc.com/id/40279101 [11/19/10]

8 - cnbc.com/id/40155548 [11/12/10]

9 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=DJIA&close_date=11%2F19%2F09&x=0&y=0 [11/19/10]

9 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=COMP&close_date=11%2F19%2F09&x=0&y=0 [11/19/10]

9 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=SPX&close_date=11%2F19%2F09&x=0&y=0 [11/19/10]

9 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=DJIA&close_date=11%2F18%2F05&x=0&y=0 [11/19/10]

9 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=COMP&close_date=11%2F18%2F05&x=0&y=0 [11/19/10]

9 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=SPX&close_date=11%2F18%2F05&x=0&y=0 [11/19/10]

9 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=DJIA&close_date=11%2F20%2F00&x=0&y=0 [11/19/10]

9 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=COMP&close_date=11%2F20%2F00&x=0&y=0 [11/19/10]

9 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=SPX&close_date=11%2F20%2F00&x=0&y=0 [11/19/10]

10 - ustreas.gov/offices/domestic-finance/debt-management/interest-rate/real_yield.shtml [11/19/10]

10 - ustreas.gov/offices/domestic-finance/debt-management/interest-rate/real_yield_historical.shtml [11/19/10]

11 - treasurydirect.gov/instit/annceresult/press/preanre/2000/ofm11200.pdf [7/12/00]

This material was prepared by Peter Montoya Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information should not be construed as investment, tax or legal advice. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.