It's

hard to describe single-digit first half returns as a raging bull market, but

it's also hard to feel too negative about a six month period when the S&P

500 recorded 22 record highs and virtually everything in your

portfolio--including bonds--rose in value.

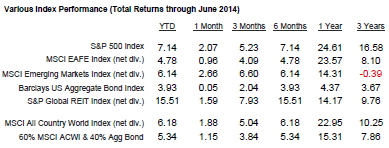

Key index performance is shown in the table below.

Large cap stocks, represented by the Russell 1000

large-cap index returned 5.12% for the quarter, up 7.27% for the year, while

the widely-quoted S&P 500 index of large company stocks gained 4.69% for

the quarter and is up 6.05% since January 1.

The

Russell midcap index was up 4.97% for the

quarter, and now stands at a 8.67% gain so far this year.

Small

company stocks, as measured by the Russell 2000

small-cap index was up 1.95% in the second three months of the year, posting a

3.19% gain in the year's first half. The

technology-heavy Nasdaq Composite Index was up 5.94% for the quarter, and is up

5.30% for its investors so far this year, reaching levels that haven't been

seen since March 2000.

The

rest of the world is not doing as well.

The broad-based EAFE index of larger foreign companies in developed

economies rose 2.95% in dollar terms during the second quarter of the year, and

is up the same 2.95% so far this year.

The stocks across the Eurozone economies rose 1.90%, and are now up

3.45% for the first half of the year.

Looking

over the other investment categories, real estate investments, as measured by

the Wilshire REIT index, rose 7.47% for the quarter, and is standing at a

remarkable 18.36% gain for the year. Commodities,

as measured by the S&P GSCI index, rose 2.69% this past quarter, posting a

gain of 5.71% for the year.

Most

market participants and pundits expected bond rates to rise in the first half

of the year, but once again bond returns surprised the experts. The Bloomberg U.S. Corporate Bond Index now

has an effective yield of just 2.90%, while comparable yields in the Eurozone

stand at 1.64%.

Treasury

rates took their biggest first-half drop since 2010. 30-year Treasuries have seen their yields fall

to 3.36% in the past six months, and 10-year Treasuries currently yield

2.53%. At the low end, 3-month T-bills

are still yielding a miniscule 0.04%; 6-month bills are only slightly more

generous, at 0.06%.

One

of the most interesting questions batted around among professional investors

these days is: are these low yields sustainable in the future? Can they keep dropping? Won't the appetite for Treasuries finally dry

up, forcing rates higher? If you look at

Treasury rates in isolation, current rates seem to be as low as they can

go. But it is also interesting to look

at the global bond markets from an international investor's perspective. Would you prefer to invest in U.S. 10-year

Treasuries at 2.53%, or buy comparable Japanese government bonds, yielding just

0.563%. Are you more attracted to German

10-year bunds, trading at 1.25% yields?

As little as they are yielding today, U.S. government bonds are still

pulling in buyers from around the world, both as a safe haven and as a source

of higher yields.

But

depending on where you look, the economic news has been somewhat scary. The U.S. economy's GDP dropped 2.9% in the

first quarter of the year--an enormous hit which has been largely blamed on the

weather. The uncertainty in Iraq,

including the recent ISIS capture of a major refinery, has sent the spot price

of oil above $107 a barrel on global markets.

Manufacturing activity fell in the past month, and the growth of jobs,

which looked promising last year, has slowed down, with the unemployment rate

stuck at 6.3%.

There

are also positive signs, particularly in the statistics for housing

demand. The pending home sales index for

contracts to purchase previously-owned U.S. homes rose 6.1% in May, the largest

advance since April 2010, when sales were boosted because the homebuyer's tax

credit was on the verge of expiration.

The rise in the overall REIT index suggests a strong bounceback in the

real estate industry overall.

Even

the government seems to be getting its books back in balance. You won't read about it in the newspapers,

but the U.S. federal deficit has fallen from $1.4 trillion to around $400

billion in the space of one year. And

the U.S. is now close to energy self-sufficiency, which means that the trade

deficit (which has been largely driven by the cost of importing Middle Eastern

oil) is shrinking dramatically vis a vis the rest of the world.

The

Michigan Sentiment Index recently hit 82.5, which means that people are

generally optimistic about the state of the economy and the world.

Where

do we go from here? The future is never

clear, but today it might be less clear than usual. The long bull market that started in March

2009 and the economic expansion that started nearly at the same time are both

among the longest since the Civil War.

Bull markets have to end eventually; we all know that. However, this growth period has been more

like a marathon than the usual recovery sprint after a recession; the economy

has grown at a 2% annualized rate since 2009, which is below the long-term

average, and considerably below what is normal during a recovery from economic

malaise. Marathon runners--at least in

theory--can keep moving longer than sprinters.

Is that the case today? The U.S.

Federal Reserve has vowed to keep interest rates low for the next 12 months,

and many investors seem to be comfortable with with this approach, believing it

could be a recipe for more economic growth, profits and clear stock market

sailing in the foreseeable future.

The

truth is, none of us can tell whether the markets will continue to test records

or not. The best indicator, and it is

not something you can pin down, is whether people are still anxious about the

future and concerned about the possibility of a market plunge. So long as people are still worried, the

market probably hasn't reached its top.

Whenever you see most investors finally deciding that the market is on a

permanent upward climb, whenever everybody finally gives up on worry and puts

their money into the hot market, that is when stocks have probably peaked, and

an unpleasant surprise awaits those who joined the party too late.

Where

are we on this scale? Few investors seem

to be enthusiastic about current market valuations, which some believe to be a

bit overpriced. At the same time, the

sentiment surveys are in the "complacent" zone, and we are not

hearing quite the same shrill tone from perma-bears and pundits who probably

feel a bit embarrassed about predicting disaster over and over again as the

markets sailed through scary headlines and economic headwinds.

This

may be the perfect time to celebrate the fact that we've managed to stay

invested during fearful times, when government shutdowns, European banking

crises and the threat of another meltdown at home were driving others away from

the improbable upward trend. Since 2009,

only the brave have stayed the course, and they earned the rewards of what, in

retrospect, has been one of the most generous bull markets in U.S. history. How much more is in store for them, or when

the inevitable pullback will come, is not something we mortals are given to

know--despite the loud predictions you will hear from economists and pundits

whose crystal balls are no more clear than yours.

Kevin Kroskey, CFP®, MBA

This article adapted with permission from Bob Veres.

Sources:

Wilshire

index data: http://www.wilshire.com/Indexes/calculator/

Russell

index data: http://www.russell.com/indexes/data/daily_total_returns_us.asp

S&P

index data: http://www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa-500-usduf--p-us-l--

Nasdaq

index data: http://quicktake.morningstar.com/Index/IndexCharts.aspx?Symbol=COMP

International

indices: http://www.mscibarra.com/products/indices/international_equity_indices/performance.html

Commodities

index data: http://us.spindices.com/index-family/commodities/sp-gsci

Treasury

market rates: http://www.bloomberg.com/markets/rates-bonds/government-bonds/us/

Aggregate

corporate bond rates: https://indices.barcap.com/show?url=Benchmark_Indices/Aggregate/Bond_Indices

Aggregate

corporate bond rates: http://www.bloomberg.com/markets/rates-bonds/corporate-bonds/