Friday, the Obama administration presented a plan to wind down Fannie Mae and Freddie Mac by 2018, with Treasury Secretary Timothy Geithner citing “very broad consensus” that the government should play “a much smaller role” in the housing market. So what will replace them? The plan puts three options before Congress. In one option, the government would leave the mortgage market save for the VHA, FHA and other existing agencies. Two other options would set up “re-insurance” programs. A limited version would guarantee private mortgages only in economic or real estate downturns; another would provide a backstop for mortgage investments already guaranteed by private insurers. All three options would pave the way for higher mortgage costs. The Treasury and HUD have also suggested phasing in a short-term requirement for borrowers as Fannie and Freddie are unwound: homebuyers would have to put 10% down for any mortgage backed by the GSEs.1,2

CONSUMERS FEEL MORE UPBEAT

The latest Reuters/University of Michigan consumer sentiment survey is in, and the initial February reading is 75.1, an improvement from the final January mark of 74.2. This is the best reading since June 2009. The survey’s current conditions index rose 5.0% to 86.8 – the highest it has been in 37 months.3

GOLD ADVANCES, OIL PULLS BACK

Gold prices climbed 0.86% last week to settle at $1,359.90 an ounce Friday – it was the best week for the precious metal YTD. Oil and natural gas prices fell to their lowest levels since November on Friday after Egyptian president Hosni Mubarak announced his resignation; natural gas futures fell 9.28% on the week, and oil slipped 3.88% for the week to settle at $85.58 per barrel on the NYMEX.4

DJIA CLOSES AT HIGHEST MARK SINCE 6/16/08

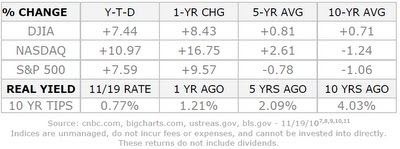

The Dow logged an eight-day winning streak from January 31 to February 9, and it has advanced in 10 of the past 11 weeks. The weekly performance? DJIA, +1.50% to 12,273.26; NASDAQ, +1.45% to 2,809.44; S&P 500, +1.39% to 1,329.15.5

THIS WEEK: Very little is scheduled for either Monday or Friday. Tuesday brings January retail sales numbers and a report on December business inventories, plus 4Q earnings from Dell, Barclays and Tesla. Wednesday offers the January Producer Price Index, the most recent FOMC minutes, reports on January housing starts and industrial output and 4Q results from Comcast and CBS. Thursday, we get the January Consumer Price Index, the Conference Board’s latest LEI, new initial claims numbers and earnings from Nordstrom.

WEEKLY QUOTE

“The spirit, the will to win, and the will to excel are the things that endure. These qualities are so much more important than the events that occur.”

– Vince Lombardi

WEEKLY TIP

Students who want to enter college this fall should complete the FAFSA early in 2011 to increase eligibility for student aid. After completing it, they should apply for scholarships as soon as possible.

Best Regards,

Kevin Kroskey

Citations.

1 - blogs.abcnews.com/george/2011/02/the-end-of-fannie-mae-and-freddie-mac.html [2/11/11]

2 - cnbc.com/id/41529671 [2/11/11]

3 - marketwatch.com/story/us-consumer-sentiment-rises-in-february-2011-02-11 [2/11/11]

4 - blogs.wsj.com/marketbeat/2011/02/11/data-points-energy-metals-459/ [2/11/11]

5 - cnbc.com/id/41537483 [2/11/11]

6 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=DJIA&close_date=2%2F11%2F10&x=0&y=0 [2/11/11]

6 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=COMP&close_date=2%2F11%2F10&x=0&y=0 [2/11/11]

6 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=SPX&close_date=2%2F11%2F10&x=0&y=0 [2/11/11]

6 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=DJIA&close_date=2%2F10%2F06&x=0&y=0 [2/11/11]

6 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=COMP&close_date=2%2F10%2F06&x=0&y=0 [2/11/11]

6 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=SPX&close_date=2%2F10%2F06&x=0&y=0 [2/11/11]

6 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=DJIA&close_date=2%2F12%2F01&x=0&y=0 [2/11/11]

6 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=COMP&close_date=2%2F12%2F01&x=0&y=0 [2/11/11]

6 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=SPX&close_date=2%2F12%2F01&x=0&y=0 [2/11/11]

7 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [2/11/11]

7 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [2/11/11]

8 - treasurydirect.gov/instit/annceresult/press/preanre/2001/ofm11001.pdf [1/10/01]

9 - http://montoyaregistry.com/Financial-Market.aspx?financial-market=wills-and-living-trusts&category=30 [2/13/11]

This material was prepared by