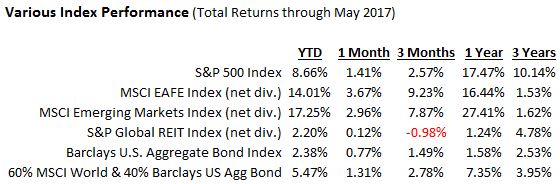

The month of May was strongly positive for international markets as stock markets in both international developed (3.67%) and emerging (2.96%) economies not only provided positive returns but also received a tailwind in the U.S. dollar’s continued trend downward. The S&P 500 was also positive (1.41%) as were bonds (0.77%) during the month.

Key Monthly Economic News

- Employment: We saw wage growth continuing with average hourly earnings increasing by $0.07 to $26.19, following a $0.05 increase in March. Over the last 12 months ended in April, average hourly earnings have risen by $0.65, or 2.5%.

- Interest rates: The Federal Open Market Committee conceded that consumer spending may have slowed in the first quarter, prompting the Committee to leave interest rates unchanged at 0.75%-1.00%. Continued strength in employment and increases in consumer spending and inflation next month may prompt the FOMC to consider a rate increase when it next meets in June.

- GDP: Expansion of the U.S. economy slowed over the first three months of 2017. According to the Bureau of Economic Analysis, the first-quarter 2017 gross domestic product grew at an annualized rate of 1.2%. The fourth-quarter 2016 GDP grew at an annual rate of 2.1%.

- Inflation: For the year, consumer prices are up 2.2%. Core prices, which exclude volatile food and energy, increased 0.1% for the month and have climbed 1.9% since April 2016.

- International markets: The election of Emmanuel Macron as France's president was greeted favorably by eurozone investors early in May.

Looking Ahead

Economic signs were mixed last month. It is not certain that the FOMC will raise interest rates when it meets in June, yet their stated path is to expect more rate increases in 2017. The final GDP figures for the first quarter are out in June. Consumer spending has been relatively weak through much of the first part of 2017, causing inflation to slow a bit.

As always: stay disciplined, focus on those things you can control, and ignore the rest.

To Your Prosperity,

Kevin Kroskey, CFP®, MBA

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e. wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

Market indices listed are unmanaged and are not available for direct investment.