President Obama signed the 2010 Tax Relief Act into law on December 17 after overwhelming passage in the House and Senate. The Bush-era tax cuts are thereby extended. Through 2012, the federal income tax tops out at 35% and taxes on dividends and capital gains top out at 15%. The 0% rate for long term gains realized in the 15% tax bracket is still in place and presents a tremendous tax planning opportunity, particularly for retirees that haven't yet started receiving Social Security and/or pension income.

Next year, the estate tax returns at 35% with a $5 million dollar exemption, effectively permitting couples to pass estates as large as $10 million to heirs; tax-free charitable IRA donations also come back in 2011. Employee payroll taxes will drop from 6.2% to 4.2% next year.1,2,3,4,5

A POSITIVE SIGNAL FOR THE FUTURE

The Conference Board’s leading economic indicators index (designed to be a gauge of economic momentum or lack thereof) jumped by 1.1% in November – the biggest gain in eight months. This follows a revised 0.4% advance in the index for October.6

PRODUCER PRICES OUTPACE CONSUMER PRICES

Consumer prices inched up 0.1% in November according to the Labor Department’s Consumer Price Index. The core CPI rose 0.1%. The Producer Price Index, on the other hand, rose by 0.8% last month. Consensus polls of economists at Briefing.com had projected a 0.2% rise in the CPI and a 0.5% gain in wholesale prices.7

HOUSING STARTS TURN NORTH

They improved for the first time in three months. The Commerce Department said November’s housing starts were up 3.9% from October levels. The 555,000 annual pace topped the 559,000 consensus projected in a Bloomberg News survey.8

STOCKS ADVANCE

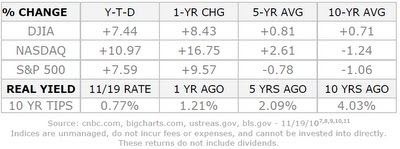

It was a pretty quiet week on Wall Street, and major index performance across the five trading days was as follows: Dow, +0.72% to 11,491.91; S&P 500, +0.28% to 1,243.91; NASDAQ, +0.21% to 2,642.97. As of Friday, the DJIA had traded within a range of 100 points for six straight market days – that hadn’t occurred since January 2006. All three indices ended the week at +10% or better for 2010.9

COMING NEXT WEEK: No notable releases on Monday or Tuesday. Wednesday, we have the latest existing home sales figures and the final estimate of 3Q GDP. Thursday, we get data on consumer spending and durable goods orders for November, new home sales figures for November, the final University of Michigan consumer sentiment survey for December, and the latest initial and continuing claims numbers. That’s it for the week.

WEEKLY QUOTE

“It is not the years in your life but the life in your years that counts.”

– Adlai Stevenson

WEEKLY TIP

With the new year coming, one of your resolutions can be reviewing and/or rebalancing your portfolio, to see that your investments are in sync with your objectives.

Happy Holidays,

Kevin Kroskey

Citations.

1 edition.cnn.com/2010/POLITICS/12/17/tax.deal/ [12/17/10]

2 – online.wsj.com/article/SB10001424052748703296604576005430598327972.html [12/7/10]

3 –tax.cchgroup.com/downloads/files/pdfs/legislation/bush-taxcuts.pdf [12/16/10]

4 – businessweek.com/ap/financialnews/D9K5IEN81.htm [12/17/10]

5 – npr.org/2010/12/10/131969824/some-worry-payroll-tax-cut-threatens-social-security [12/17/10]

6 - bloomberg.com/news/2010-12-17/u-s-leading-indicators-index-gains-most-in-eight-months-in-recovery-sign.html [12/17/10]

7 - thestreet.com/story/10947594/1/inflation-remains-subdued-in-november.html [12/15/10]

8 - bloomberg.com/news/2010-12-16/u-s-futures-fluctuate-starbucks-bank-of-america-climb-freeport-slides.html [12/16/10]

9 - cnbc.com/id/40722779 [12/17/10]

10 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=DJIA&close_date=12%2F17%2F09&x=0&y=0 [12/17/10]

10 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=COMP&close_date=12%2F17%2F09&x=0&y=0 [12/17/10]

10 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=SPX&close_date=12%2F17%2F09&x=0&y=0 [12/17/10]

10 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=DJIA&close_date=12%2F16%2F05&x=0&y=0 [12/17/10]

10 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=COMP&close_date=12%2F16%2F05&x=0&y=0 [12/17/10]

10 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=SPX&close_date=12%2F16%2F05&x=0&y=0 [12/17/10]

10 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=DJIA&close_date=12%2F18%2F00&x=0&y=0 [12/17/10]

10 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=COMP&close_date=12%2F18%2F00&x=0&y=0 [12/17/10]

10 - bigcharts.marketwatch.com/historical/default.asp?detect=1&symbol=SPX&close_date=12%2F18%2F00&x=0&y=0 [12/17/10]

11 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [12/17/10]

11 - ustreas.gov/offices/domestic-finance/debt-management/interest-rate/real_yield_historical.shtml [12/17/10]

12 - treasurydirect.gov/instit/annceresult/press/preanre/2000/ofm11200.pdf [7/12/00]

13 - montoyaregistry.com/Financial-Market.aspx?financial-market=8-retirement-tips&category=3 [12/18/10]

This material was prepared by Peter Montoya Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information should not be construed as investment, tax or legal advice. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.