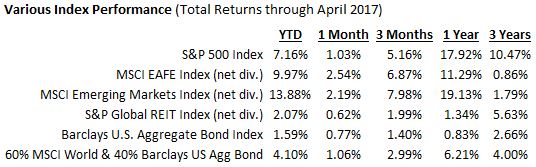

The month of April yielded positive returns for all major indices with international stock markets leading on the heels of the boost from the French elections. Emerging Markets are the best performing asset class now up 13.88% for 2017. A 60% stock and 40% bond balanced portfolio is up 4.10%.

April’s Economic Highlights

- Employment: The employment report for March showed job hirings slowed to 98,000 following gains of 219,000 in February and 216,000 in January, revised. Average hourly earnings increased by $0.05 to $26.14, following a $0.06 increase in February. Over the last 12 months ended in March, average hourly earnings have risen by $0.68, or 2.7%.

- Interest rates: The Federal Open Market Committee did not meet in April, but is scheduled to meet during the first week of May. While the FOMC anticipated raising interest rates three times during 2017, some members of the Committee will want to see solid economic growth before voting to increase rates at the next FOMC meeting in May. [Update: on 5/3/2017, After its two-day policy meeting, the Federal Open Market Committee unanimously voted to hold the federal funds rate between 0.75% and 1.00%, citing slowing economic growth.}

- GDP: Expansion of the U.S. economy slowed over the first three months of 2017. According to the Bureau of Economic Analysis, the first-quarter 2017 gross domestic product grew at an annualized rate of 0.7% compared to the fourth-quarter 2016 GDP, which grew at an annual rate of 2.1%.

- Inflation: Consumer prices also retreated in March, slipping 0.3% from February. For the year, consumer prices are up 2.4%. Core prices, which exclude food and energy, dropped 0.1% for the month and have increased 2.0% since March 2016.

- International markets: In France, the rise of Emmanuel Macron, a former investment banker, as the heavy favorite to win the May 7 presidential race sent stocks and the euro higher, as the eurozone continues to gain its economic footing following the financial crisis of 2008. Greece reached a budget surplus that's eight times higher than the 0.5% primary target set by its creditors. This bodes well for continued bailout support for the financially embattled country.

As always: stay disciplined, focus on those things you can control, and ignore the rest.

To Your Prosperity,

Kevin Kroskey, CFP®, MBA

Data sources: Economic: Based on data from

U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of

Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller

20-City Composite Index (home prices); Institute for Supply Management

(manufacturing/services). Performance: Based on data reported in WSJ Market

Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information

Administration/Bloomberg.com Market Data (oil spot price, WTI Cushing, OK);

www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange

rates). News items are based on reports from multiple commonly available

international news sources (i.e. wire services) and are independently verified

when necessary with secondary sources such as government agencies, corporate

press releases, or trade organizations. All information is based on sources

deemed reliable, but no warranty or guarantee is made as to its accuracy or

completeness. Neither the information nor any opinion expressed herein

constitutes a solicitation for the purchase or sale of any securities, and

should not be relied on as financial advice. Past performance is no guarantee

of future results. All investing involves risk, including the potential loss of

principal, and there can be no guarantee that any investing strategy will be

successful.

The Dow Jones Industrial Average (DJIA) is a

price-weighted index composed of 30 widely traded blue-chip U.S. common stocks.

The S&P 500 is a market-cap weighted index composed of the common stocks of

500 leading companies in leading industries of the U.S. economy. The NASDAQ

Composite Index is a market-value weighted index of all common stocks listed on

the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index

composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted

index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar

Index is a geometrically weighted index of the value of the U.S. dollar

relative to six foreign currencies. Market indices listed are unmanaged and are

not available for direct investment.