“The economy is still struggling; too many Americans are still out of work; and the Nation’s long-term fiscal trajectory is unsustainable, threatening future prosperity,” according to the Mid-Session Review submitted by the White House last week. This supplemental update of the annual budget contained a number of projections that are of interest to us. Here are a few:

• A projected federal deficit of $2.9 trillion over the next two fiscal years.

• Gross Domestic Product projected to grow 3.2% this year, 3.6% in 2011, and 4.2% in 2012.

• Unemployment projected to average 9.7% this year, 9.0% in 2011, and 8.1% in 2012. It is projected to stay above 6% until 2015.

• The consumer price index projected to rise 1.6% this year, 1.3% next year, and 1.8% in 2012.

• The 10-year Treasury projected to yield on average 3.5% in 2010, 4.0% in 2011, and 4.6% in 2012.

Projections like this are, of course, notoriously difficult to get right. So much can happen in a short period and throw off the best laid plans. But, looking at the projections at least gives us a place to start. Overall, the projections are a mixed bag. The deficit numbers are problematic. The GDP growth projection is good if we can hit it. The unemployment numbers are painful. The inflation outlook is stable and the Treasury yield is favorable for business growth.

If, by the end of 2012, the above numbers come to fruition, then we would likely avoid a double-dip recession and the economy would probably “muddle along.” So far, corporate America is doing its part by showing really solid earnings for the second quarter. Companies such as Caterpillar, 3M, AT&T, and UPS notched solid quarters and suggest there is underlying strength in the economy, according to MarketWatch. In fact, of the 175 companies in the S&P 500 that have already reported their second quarter earnings, a whopping 78% have beaten analysts’ estimates while only 12% missed, according to data from Thomson Reuters as reported by MarketWatch. Buoyed by good earnings and relief over the European bank stress tests, the S&P 500 rose a solid 3.6% last week.

Given all the volatility we’ve had over the past 2½ years, “muddle along” might not be so bad!

WHETHER AN INVESTOR LEANS BULLISH OR BEARISH, there is ample data to support either view. This situation may explain why Fed Chairman Ben Bernanke told Congress last week that the economic outlook was “unusually uncertain.” For those investors who lean bullish, here are several supporting points courtesy of economist David Rosenberg as reported by Financial Times:

• Congress extended jobless benefits, which is one form of stimulus.

• Some Democrats are now in favor of delaying tax hikes.

• China is having some success slowing its property bubble without bursting it.

• Confidence is growing that the emerging markets may keep world growth positive even if more mature countries slow down.

• Eurozone debt and money markets have settled down after the problems with Greece sparked default fears.

• The European bank stress tests contained no major surprises and added clarity to the soundness of the banking system.

• Consumer credit delinquency rates in the U.S. are improving.

• Mortgage delinquencies in California, one of the hardest hit real estate markets, are at a three-year low.

• The BP oil spill is coming under control and is no longer each day’s top headline.

• The passage of the financial regulation bill removed one more cloud of uncertainty.

• Corporate America is reporting solid earnings for the second quarter and their future outlook has been, on balance, positive.

• Fed Chairman Ben Bernanke indicated he’ll keep using monetary policy to stimulate the economy and he’ll get even more aggressive if need be.

So, yes, there are reasons why the markets and the economy could do okay in the months to come. But, in this “unusually uncertain” time, almost anything is possible.

Best regards,

Kevin Kroskey

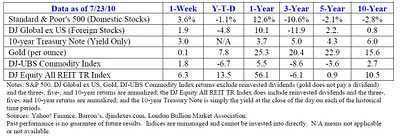

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

* The DJ Global ex US is an unmanaged group of non-U.S. securities designed to reflect the performance of the global equity securities that have readily available prices.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the London afternoon gold price fix as reported by the London Bullion Market Association.

* The DJ Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT TR Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* This newsletter was prepared by PEAK.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.