Has corporate America lost its gumption?

Three of the things that have made the United States so great are the determination, fearlessness, and entrepreneurial spirit of our people. Unfortunately, that seems to be a bit lacking right now with the leaders of some of our country’s largest companies.

For more than two years now, corporate America has been on a belt-tightening, cost-cutting push that has helped contribute to our high unemployment rate. While that has been bad for employees, it has sparked a significant revival in corporate profits. For example, according to a New York Times article based on data from the Bureau of Economic Analysis, second quarter corporate profits were within 4% of their pre-recession peak. And, by another measure, Barron’s magazine pointed out that corporate profits as a percentage of gross domestic product are near 40-year highs.

So, if corporate America is doing so well, why aren’t they hiring and why is the stock market stuck in neutral?

In a word -- uncertainty.

Even top Federal Reserve officials are having a hard time agreeing on what to do next to help the economy. On August 10, 17 of them met and, according to an August 24 Wall Street Journal article, at least seven of them spoke against or expressed reservations about the ultimate decision Chairman Bernanke made to keep the Fed’s balance sheet from shrinking. Toss in government regulation, an upcoming mid-term election, tax policy uncertainty, a deflation/inflation debate, and stubbornly high unemployment, and there’s plenty to muddy up the waters.

Corporate America is reacting to this uncertainty by conserving cash and keeping a lid on hiring. However, this will eventually change, and, on a positive note, we may be starting to see that happen as corporate acquisitions are on the rise. The current bidding war between two blue-chip technology companies for an obscure data-storage company may be one example of gumption returning to the boardroom… and that’s good!

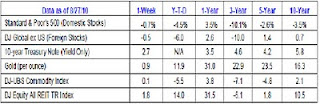

Notes: S&P 500, DJ Global ex US, Gold, DJ-UBS Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT TR Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable or not available.

WHO HAS A WORSE DEBT BURDEN, countries in developed markets or countries in emerging markets? Well, by at least one measure, developed countries are in worse shape.

WHO HAS A WORSE DEBT BURDEN, countries in developed markets or countries in emerging markets? Well, by at least one measure, developed countries are in worse shape.

According to the August 2010 newsletter from Research Affiliates, LLC, “Developed markets account for 62% of the world’s GDP and owe 90% of the world’s sovereign bond debt. The emerging markets collectively produce 38% of the world’s GDP and owe just 10% of world sovereign bond debt.” In other words, relative to the size of its economies, developed market countries (like the U.S.) have a much higher debt burden.

This debt level is problematic because it hampers a country’s ability to grow. On the flip side, emerging market countries that are not swimming in debt are some of the fastest growing in the world. China is a good example. Its breakneck growth has led to a 60-mile long traffic jam on a main highway leading into Beijing that is still unfolding, according to The New York Times. The culprit? A parade of coal trucks trying to supply the rapidly growing energy needs of Beijing.

Over time, as the developed world tries to pare its debt through austerity programs, sluggish growth may result. World leaders are banking on emerging countries like China to help pickup the economic slack. The extent to which these emerging countries can do that may have a big impact on how long the U.S. stays stuck in neutral.

Weekly Focus – Think About It

“Don't waste life in doubts and fears; spend yourself on the work before you, well assured that the right performance of this hour's duties will be the best preparation for the hours and ages that will follow it.”

--Ralph Waldo Emerson

Best regards,

Kevin Kroskey

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

* The DJ Global ex US is an unmanaged group of non-U.S. securities designed to reflect the performance of the global equity securities that have readily available prices.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the London afternoon gold price fix as reported by the London Bullion Market Association.

* The DJ Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT TR Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Past performance does not guarantee future results.

* You cannot invest directly in an index.

* Consult your financial professional before making any investment decision.

* This newsletter was prepared by PEAK.